As the world of cryptocurrency changes, the debate between centralized and decentralized exchanges (CEXs and DEXs) is still going strong. Each has its own set of pros and cons, as well as different ways they can be used, especially in places like Africa, where platforms like Uptota.com are making it easier for people to access financial services.

Centralized vs. Decentralized Exchanges: An Overview

Centralized Exchanges (CEXs) are run by a central team that makes it easy for users to trade with each other. Platforms like Uptota have great interfaces, customer support and lots of fiat-to-crypto options, which makes them great for beginners. It’s important to be able to trust the platform to manage your funds and execute trades.

Decentralized Exchanges (DEXs) operate on blockchain technology without intermediaries. Trades are executed through smart contracts, and users retain control over their assets, offering increased privacy and reduced vulnerability to centralized risks.

Advantages and Disadvantages of Centralized Exchanges

Advantages:

- User-Friendliness:

CEXs like Uptota make it easier for people to get into crypto by offering simple interfaces and helpful customer support - Liquidity and Speed:

High trading volumes mean quick transactions, minimal slippage and competitive pricing. - Security and Regulation:

You can trust CEXs to have solid security measures in place and to stick to the rules. They offer protection through insurance, and they’re monitored. - Comprehensive Services:

The new tools, apps and staking options, plus the fiat integration, make trading a much better experience.

Disadvantages:

- Centralized Control:

Users have to trust the platform with their funds, which introduces some risks. - Regulatory Vulnerability:

Any changes to the regulations might affect how we operate or what users can do. - Privacy Concerns:

Personal data is often needed to comply with regulations, which can reduce user anonymity. Changes in regulations may affect how we operate or how accessible our services are to users

Practical Use Cases for Centralized Exchanges in Africa

Africa brings with it some pretty unique challenges, like limited access to traditional banking and currency instability. In this context, CEXs like Uptota are really important.

They help in:

- Financial Inclusion:

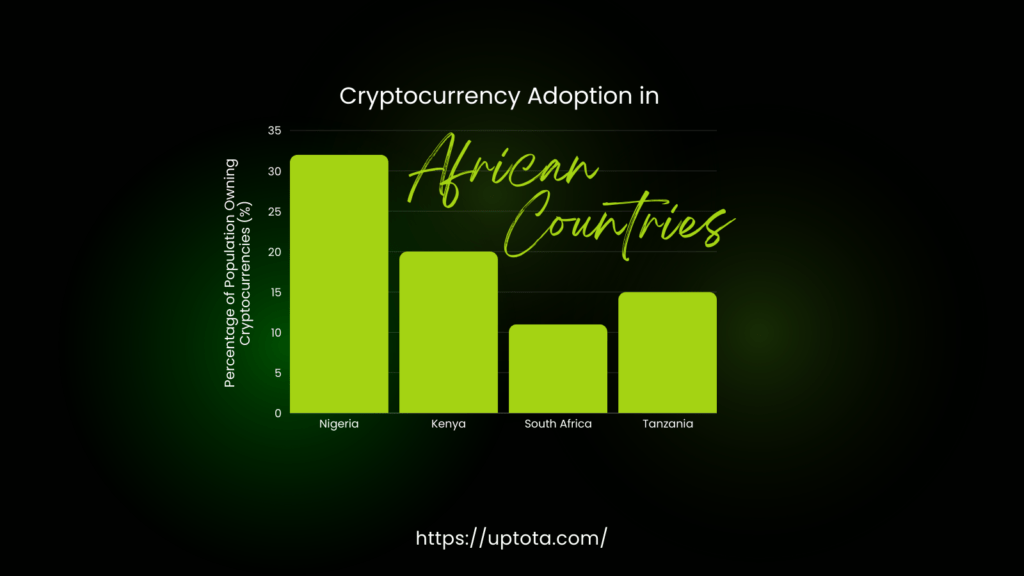

Many Africans don’t have access to traditional banking services. Uptota makes it easy for people across the continent to get involved in crypto trading, which helps boost the economy. - Inflation Protection:

Another great thing about crypto is that it offers inflation protection. Cryptocurrencies are a great way to protect yourself against volatile local currencies. In places like Zimbabwe and Nigeria, people are turning to digital assets more and more to protect their wealth. - Economic Empowerment:

With features like Uptota Pay and a debit card system, Uptota makes it easier for people and businesses to do everyday transactions and send money, which helps them to manage their money better. - Education and Awareness:

Uptota is working with local governments through Uptota Academy to make more people aware of cryptocurrencies, so that more people can engage with digital currencies safely.

The Future of Centralized Crypto Exchanges in Africa

The rise of centralized exchanges like Uptota is changing the way Africa does business. They’re helping to solve regional challenges with new ideas. As more Africans get into cryptocurrency, CEXs will keep connecting traditional finance with digital currency. This will help make the economy more inclusive, secure and accessible for everyone. If you want to find out more about our centralized crypto exchange in Africa, check out Uptota: Uptota.com